As we approach the end of the year (at a ridiculously fast rate) a lot of you might be thinking about what you want to do different in the new year. Whether your resolutions are big or small, I think we all have a goal to be financially savvy and more aware of our spending habits. There’s a lot of money advice out there from experts and an expert I. AM. NOT.

I won’t preach to you how to handle your money, or where to invest. But I thought that I’d share how I organize our month to month bill paying. What makes our situation unique is neither my husband or I make a salary. So paychecks are hard to predict and often vary greatly in amounts. It can be a scary way to live. Especially if you don’t have an organized system, so I’m sharing this in hopes that if you happen to be in the same boat and don’t think you can budget because of said boat…just know that you can, it might be a little more work, but it’s doable and has gotten us through some “should have been tough, but weren’t so bad months“…here’s how I handle it…

Hopefully you file your bills away every month for the year. If you don’t then make it a goal to do that starting January 1st. If you don’t physically have your last years worth of bills on hand to look back on then you can always go through your bank to get your statements and back track to find how much was paid to who.

Whenever I pay a bill (usually done online) I print out that proof of payment and staple it to the statement and file it away. I use 6 red folders, 2 months to each folder. It’s easy for me to find things this way just in case I need to pull it out during the year.

At the end of the year (now) I pull out everything from my folders and separate them into like piles. All the electricity in one pile, all the water into another…etc…

Here’s where the budgeting and guesstimating for next years bills come into play…

Open up your spread sheet application on your computer. You might have Excel if you’re on Windows, I use a Mac so I use something called Numbers.

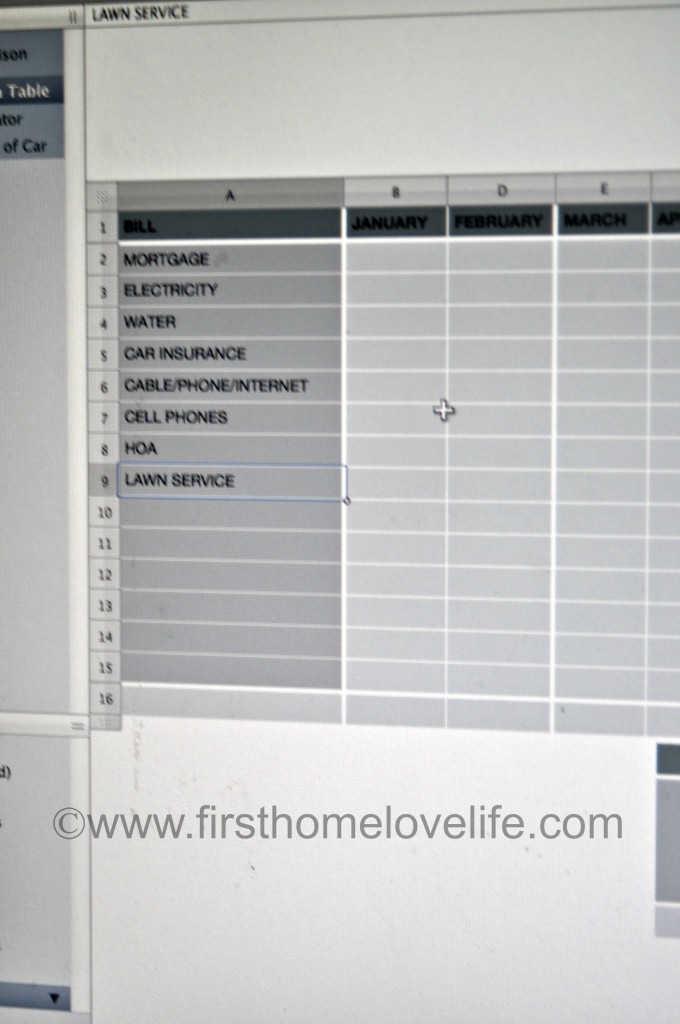

You could totally do this by hand too by the way! Just make columns with January-Decmeber and rows going across with the names of bills.

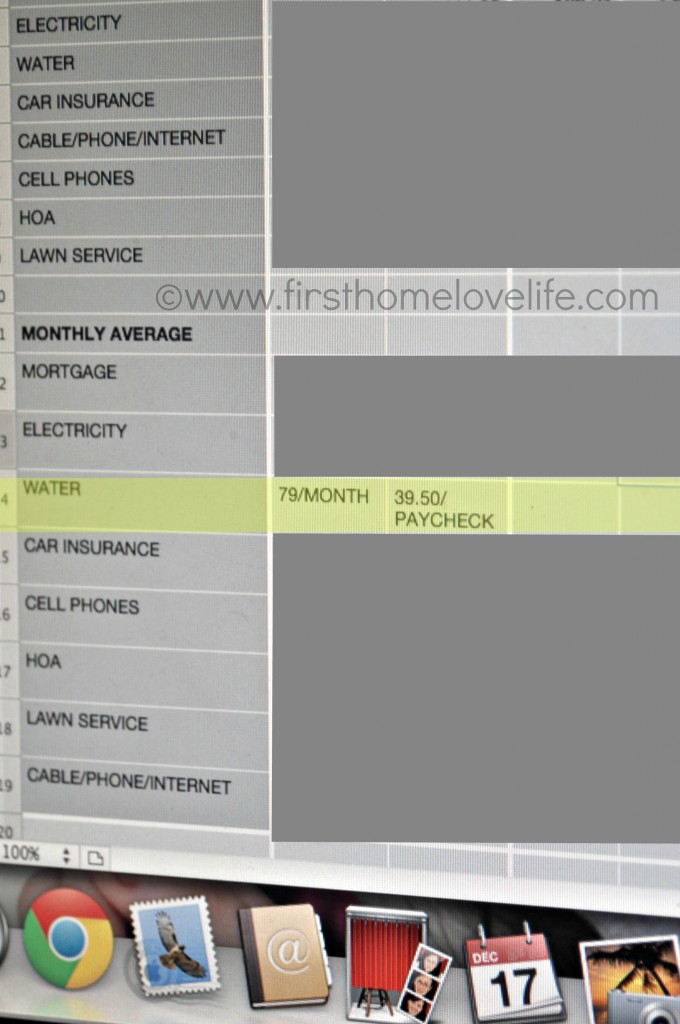

Here’s what my spreadsheet looks like…

So now, pick up one of your piles…for example purposes lets just say it’s the water bill pile. Start putting in the amounts you owed throughout the year for each month.

Continue to fill in all the rows for each bill. You will probably begin to see some sort of pattern develop. You will have better months than others, but don’t look at it as you have more money to spend those months. Use the better months when money isn’t so tight to “overfund” your bill account.

Here’s what I mean by “overfunding”…

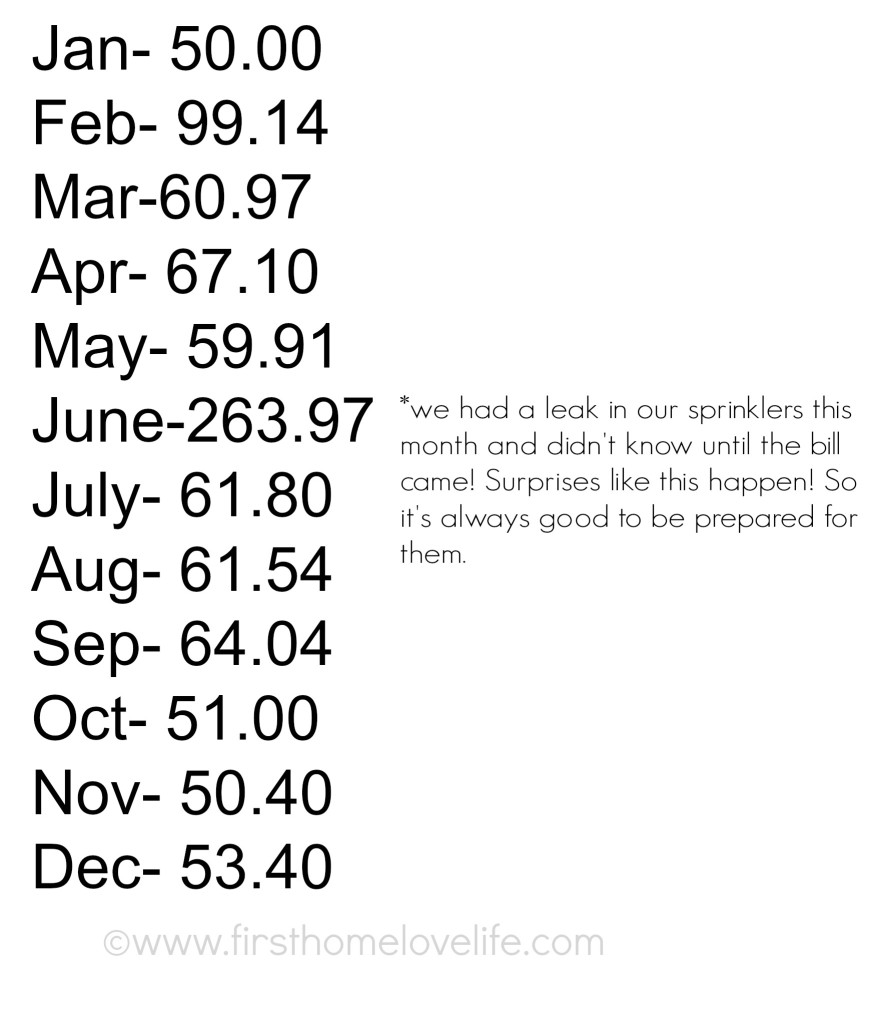

If you scroll up and look at the water portion of my spreadsheet you’ll see the different amounts owed. I’ll list them here for you as well…

So example: Water bills (above) = $943.27 yearly operating costs (divide by 12 months) =$78.61 average monthly cost (divide by 2 because we get paid biweekly) = $39.30 or just round up to $39.50 to make it easier.

Once you’ve done this for every bill, add the totals in your per paycheck column together. It will give you the lump sum of the total cost amount for all of your bills owed per paycheck.

Once I have that total…That is what I now will write out a check for every paycheck to deposit money from our checking account to our “designated bill checking account.” That account is only used to pay our monthly bills, and nothing else.

Whatever money is left over from the paycheck is split up between savings accounts, emergency fund, grocery budget, and the honey pot account (which is what we call our fun money), and we are always left with a $0.00 balance. Every single penny should have a designated purpose.

UPDATED 1/3/14: So a few people have emailed me some great questions about how to start this or to clarify some things…

#1. “How do you get started? Due dates are going to mess me up…” You’re right! If you are currently living paycheck to paycheck with no wiggle room to spare then the only thing I can suggest is how I started doing it this way and that was to wait until you get your tax return to put in an extra months worth of bills…this way you will be a month ahead give or take a few dollars every once in a while. You are definitely going to need at least a small cushion to get started so you don’t fall behind.

#2. “Are you always a month ahead when you place the corresponding amount away? For example, the money you put away from the January paycheck pays the February bills?” Yes, for the most part we are always about a month ahead. Sometimes in those “harder- more expensive months” we have to tap into the extra money that’s there, but it’s always from that designated bill checking account. This is why it’s so important to overfund your bill account in the better months so the money is there and you won’t need to tap into one of your other accounts for the money or come up short when it’s time to pay a certain bill.

#3. This wasn’t a question asked, but an additional tip I have for you that I thought you might find useful. When I set up that designated bill checking account I also set up direct bill pay for specific dates. I pay 1/2 of our bills at the beginning of the month and 1/2 towards the end of the month. Most of the companies we use give us money back or discounts for using automatic bill pay. I added it up and our savings is almost $150/month just from that. So I highly encourage you to at the very least set up direct bill pay for your bills from a designated bill checking account.

It’s not a set in stone guarantee that paychecks and bills will be exactly the same next year as they were this year, but I at least feel more in control of our finances by doing it this way. Unexpected expenses happen. But by organizing our month to month expenses and bills this way, I have found it easier to fund our savings and emergency fund for when the proverbial crap hits the fan.

I hope you’ve found this post helpful. I’d really love to hear any of your tips on how you organize paying your bills month to month!

As always, I’d love for you to stick around, so follow me on Facebook while you’re here.

Talk to you soon friends, take care!

XO

Linking up to: Tatertots and Jello

This makea a lot of sense but I have a somewhat different situation in that we are completely commissions so not onmy do they vary each time but it also varies when we get paid too. At the moment I’m just keeping tabs monthly on a spreadsheet and trying to budget that way, but it sure makes it hard to prepare for the whole year.

Thank you for this! My hubs and I are in the same boat. He works construction, which is weather-dependent. During winter months, it can get really tough. I have been trying different methods of budgeting for us and we always seem to have a hard time making anything stick because his paychecks can vary so much. Some weeks there may not BE a paycheck if the weather is really rough! So thank you for this post. It gives me a lot of hope, because I felt like other people who did financial posts really didn’t understand what it meant to be unsure of your income.

You’re so welcome Brandi! I’m so glad you found this helpful 🙂 Good luck to you!

Hello, it sounds like a great plan, but are you always a month ahead when you place the corresponding amount away? For example, the money you put away from the January paycheck pays the February bills? Thanks!

I second that….how do you get started? Due dates are going to mess me up too. Help!

Hi Billie, I updated the post with more information since others have emailed me with the same questions.

This was so helpful! I used it when putting together my own budget! Thank you!

Sarah recently posted…2014

Any suggestions on determining the amount to hold for each pay week when I am salary every 2 weeks, and hubby is irregular every week? I know you divide by 12 then by 2, should we also do the same…this math is making my head hurt, and always discourages me.

Don’t get discouraged Sara! Yes…I would do it the same way, and you have the added bonus of that salary check so you already know that amount.

Build a price range – and stick to it. Make a note of your spending habits over the course of a month. Track where every single penny goes so you can figure out where you need to have to cut back. As soon as your budget is set for the month, if you come across you commit significantly less than planned, use the extra money to spend down your debt.

Hey I just had a quick question. I know most months have two paychecks, but because there are 52 weeks in a year (26 paydays), two months of each year have three paydays. What do you do with those extra paychecks?

Such a great question! I usually put the extra towards paying off our mortgage principal 🙂 But you could use it to bulk up your savings, or splurge a little 🙂

Wow! Great system, excited to put it in use. Do you really pay that for water? I have never paid more than $10 a month, guess location really does change even the basic things.

$10?! Lucky lady! Our water must be specked with gold for the prices we pay! 😉

Just another tip if this is something you want to start doing, (I do), if you don’t have your past bill statements for your utilities, insurance, etc, but you have an account online (or sign up for one) with that company, most go back 1-2 years, and you can view and print your past statements for the past 12, 18, or 24 months from the corresponding website. 😀

Great tip, Lorena! Thank you 🙂

I have a question. After paying your bills for that pay period, should you be left with the total amount for the month or half in that account?

Sorry Jenni, I’ve read your question a few times and don’t really understand.

My husband works purely on commission so we only have a vague idea of when a check might come in. Then each check is totally different, there could be a $1000. check one week and then a $30. check the next time. Each month is feast or famine. If we could get ahead by a month, I feel like I’d have a chance. Unfortunately, we’re just squeaking by. Any suggestions?

On those ‘feast months’ put as much into your emergency fund as possible for at least a year to build up a cushion. I know it’s hard (and NOT FUN) but I like knowing that on those famine months we’ll be able to get by because I planned ahead.

Okay, thank you, Christine. It helps to know that we’re not the only ones out here dealing with this problem!

Great post and financial planner approved! Just a quick suggestion – as you pay your bills each month, you could add a column into your spreadsheet titled “Actual” vs. your “Budget” column so that you don’t have to go back through 12 months of bills around the holidays. I know from first hand experience that talking about money around the holidays is never fun and doing your budget for the following year can turn into a big project. Keeping up with it monthly keeps the budget-mountain to the size of a molehill and allows you to easily see trends throughout the year…especially if you link a line-graph to the spreadsheet. Sometimes you may need to have a conversation with your water company half-way through the year if you see the trend increasing at an unexplained pace verses last year’s trend.

I’m referring to the post about paying half bills. First the separate bill paying account u mentioned is that a separate bank account? We struggle staying ahead especially with medical bills and past debts. My husband gets paid monthly that mostly pays our mortgage . I get paid weekly but it varies some. What is best way of handling that. Creditors were calling so I went through a debt relief company to help consolidate old credit card bills. Helped not having to pay so much to several credit cards but when I get my statements doesn’t seem like it’s getting anywhere fast. Been doing it like. 3 yrs or so. I’ve recently been diagnosed with cancer again after 15 yrs. I started chemo dec 2 and will have a yrs worth of it plus surgery in a few months. Will try to work as I can but I make more than my husband so the worry is heavy on both of us. Trying to investigate things I can do from home when I can’t work as well as how to cut back where we can . We r just plain people that don’t live fancy and have 4 children 16, 12,11, 9. Plus our 16 yr is in need of a vehicle and we will b looking at senior expenses in a few months ( she’s a junior now ) so sorry for long post. Just a little down today.

Thank you so very much… I’m heading into retirement soon, for which I haven’t planned very good for. Your plan seems very easy to use and your directions are helpful. I’ve sent your article to both my son, who like his Mother is not a budget-friendly Perrin and my granddaughter who is just beginning on her own. Thank you, Chrissi. I will let you know how well I fair out. Thank you for this information and God bless. Mimi